Fix Your Credit for Less Than Your Phone BilL

Choose Your Plan

MOJO LITE

$39.95/m

We Provide the Letters, You Print and Mail Them

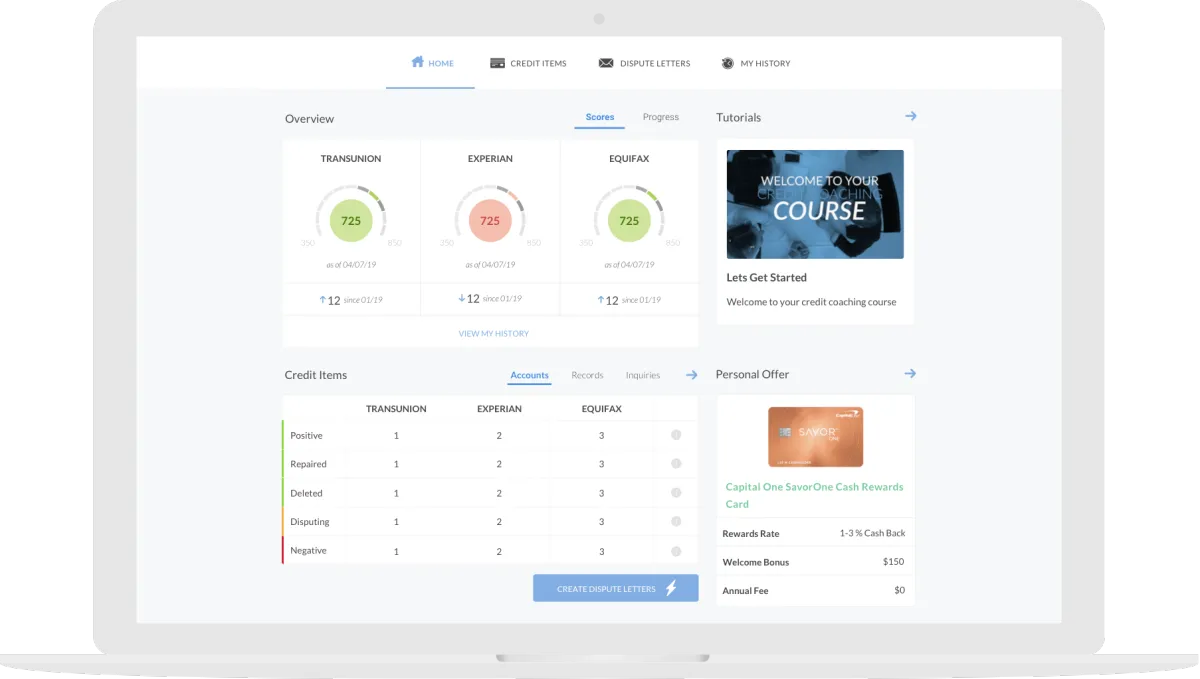

Repair Portal – Access tools to track and manage your disputes.

Full Detailed Credit Monitoring – Monitor your score & changes.

Understanding FICO Course – Learn how credit scores work.

No contracts - cancel anytime

MOJO Mastery

$49.95/m

We Provide the Letters, You Print and Mail Them

Repair Portal – Access tools to track and manage your disputes.

Full Detailed Credit Monitoring – Monitor your score & changes.

Understanding FICO Course – Learn how credit scores work.

7 Days to 740+ Course – Step-by-Step Credit Score Boost Plan

Full Access to Fortress U – Unlock All Credit & Finance Courses

LIVE Weekly Coaching Call – Ask Questions & Get Expert Help

No contracts - cancel anytime

Our CreditMojo.AIProcess

No Contracts, No Hassle, No Expensive Fees.

AI Scans Your

Credit Report

Instantly find inaccurate, outdated, and negative items that qualify for repair.

AI Writes Expert Dispute Letters

Get expertly trained crafted dispute letters backed by proven strategies.

You Simply Print, Sign, and Mail

Because letters come from you, lenders take them seriously—giving you the best chance for success.

Why AI Is Better Than Traditional Credit Repair:

AI Does It Smarter, Faster, and Cheaper.

You Stay in Control

With traditional credit repair companies, you have no visibility into the process. With CreditMojo.ai, you know exactly what’s being disputed and why—because AI creates customized letters tailored to your unique credit situation.

Lenders Take You More Seriously

When a credit repair company sends dispute letters on your behalf, lenders often ignore them. But when they come directly from you, they hold more weight—giving you better results.

No Overpriced Middlemen

Most credit repair companies charge $1,000+ for something AI can do instantly. Why pay more when you can get better results for just $39.95/month?

| Feature | CreditMojo.AI | Traditional Repair |

|---|---|---|

| Cost | $39.95 / per month | $1000+ overtime |

| Dispute Letters | AI instantly writes custom letters for you, disputing everything at once. | Generic, copy-paste templates. Disputing 1-2 accounts at a time. |

| Speed | Results in 3-6 months on average. | Takes months to years to see results. |

| Success Rate | Higher results – customer dispute letters come directly from you. | Lower results – lenders often ignore third-party disputes. |

| Transparency & Control | You see exactly what’s disputed. | No visibility into the process. |

| Commitment | No contracts, cancel anytime. | Locked into long-term contracts. |

Your Credit Report is Included

Our AI imports and analyzes your 3-bureau report

, identifying negative items and creating a custom dispute strategy —all without placing an inquiry on your credit. Smarter, faster, hassle-free credit repair.

Smart Disputes, Better Results—Tailored for Every Account

Not all negative accounts are the same—our AI tailors each dispute based on the type of account, ensuring the best approach for permanent removal. With smart, guided disputes, fixing your credit has never been easier.

Track Your Progress with Real-Time Updates

With CreditMojo.AI, staying on top of your credit repair journey is effortless. Our system monitors disputes across all three bureaus and delivers monthly updates on deleted accounts and your latest credit scores—so you always know where you stand.

Expert Guidance & Coaching for Faster Credit Improvement

Want to boost your credit score the right way? CreditMojo.AI gives you expert-led coaching with step-by-step video guides and real answers from credit pros. No fluff—just the knowledge you need to take control of your credit.

Dispute Any Account on All 3 Bureaus

Late Payments

Inquiries

Collections

Foreclosures

Reposessions

Bankruptcy

Charge-Offs

Judgements

No need to create an account with each credit bureau.

Credit Mojo brings all three credit bureaus to you.

What client say about us

Copyright 2022 . All rights reserved

Take the first step towards better credit today for $1

For only $1, you can take the first step toward better credit. Get started today and:

Activate your account and schedule your one-on-one onboarding call with a credit expert.Gain access to Fortress University, where you’ll learn how to improve your credit, pay less in taxes, and build business credit.Conduct a private review of your credit report to identify the items we can work on and receive a personalized plan for success.

Reviews

Results You Can Trust

We created Fortress because we know how frustrating the credit repair industry can be. You deserve a company that works as hard for your financial freedom as you do. See what our past client have to say about us:

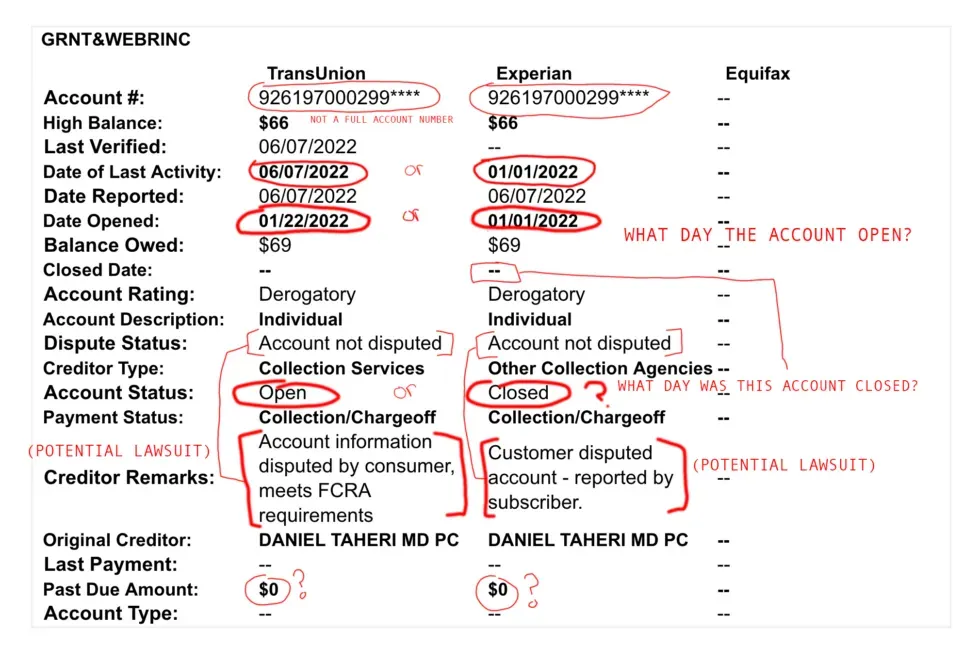

How Credit Repair Works

All Credit Reports Contain Mistakes

The law says items on a credit report must be 100% accurate and verifiable, otherwise they must be removed immediately.

Lucky for us, it's nearly impossible for them to comply. More often than not, the easiest solution is often to remove the account than fight us in court. You just need to know how to find them. It's often the seemingly small mistakes that give us the most deletions. This is why our experts go through your account line by line and create aggressive letters quoting the specific mistakes and laws the banks are violating.

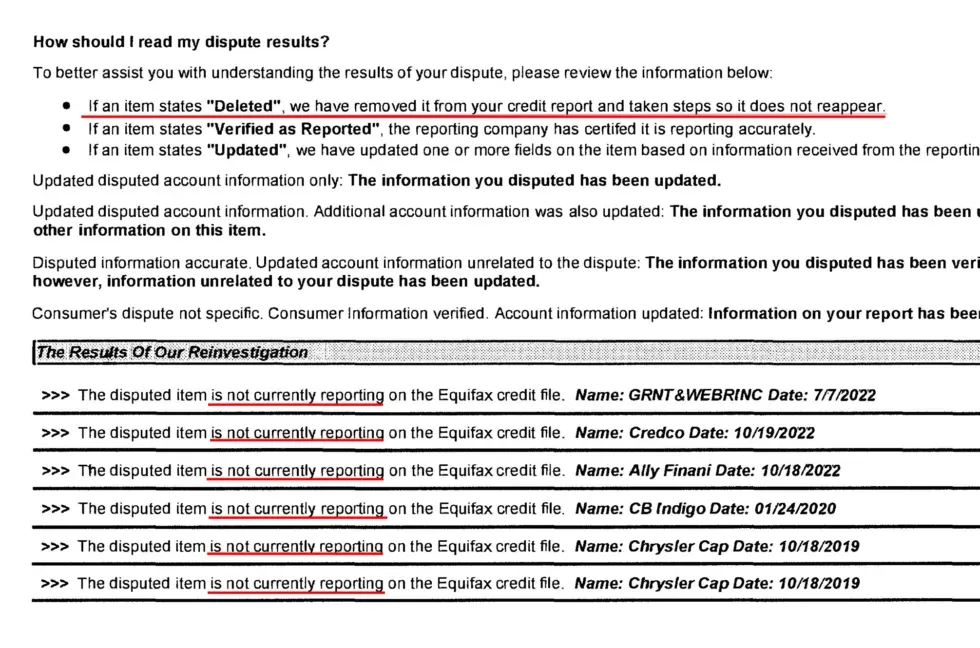

When you understand how to find mistakes and dispute them, you get results like this: